What is Fear of Missing Out (FOMO)?

I came across this FOMO term these few days when we are discussing on the current stock market. Will it be one way ticket (uptrend) or will be the final push before coming down again?FOMO is the apprehension which makes us believe that others might have rewarding experiences which we are missing out on.

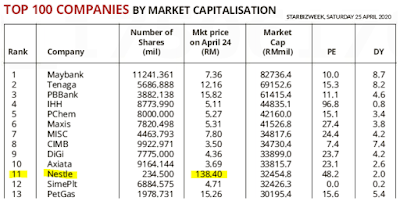

I share on the two articles on Maybank and Tenaga with one of my friend. Since then he queued Maybank price at RM7.30 for almost 3 weeks but still not successful buying it. As for Tenaga, he queued for RM12.00 also not done till now. So he called me up and complaints that is he going to miss the boat? After few minutes of discussion, he decided to change the buying price for Maybank to RM7.35. He got it on the next few days and he was so happy that able to own a portion of Malaysia biggest bank now.

Above sharing is the typical symptom of FOMO in investing. To be frank, I’m a long time investor but still struggle with FOMO and need to deal with it.

How to Avoid FOMO When Investing

There are few of the advice in order to avoid FOMO when investing.1) Start With the Goal in Mind

For any investment, you must start with end in mind. For example, what do you want to achieve in mid-term and long term. Each of the stock will have different return. Once buy in the stock, it must be monitored for a long time. From there to understand what is the correct decision to hold or sell according to the business performance.There should not be an all time winner in the market. You only can make the minimum mistake in the market. Warren Buffet also making a wrong buying call in Airlines company in March 2020, but make quick decision to sell 100% of his airline share in May 2020

Up till here, the morale of the story is we must do our own homework thoroughly and that is the only way to reduce the mistake in investing.

2) Create a financial plan and stick to it

Think about the short-and long-term financial goals you want to achieve, your time horizon and your tolerance for risk. Create a financial plan that will help you achieve those goals, and then follow it. Just like my friend story when buying into a share, purchased price already decided but because of FOMO, plan changed after reconfirm on his investment objectives. On the other hand, he also understood the probabilities of the price getting higher or lower? What proportion will end? If those probability on the down side can be accepted, then will just execute.Final word

Let's avoid FOMO, but Start Investing. Ultimately, we not be able to build a time machine to take us back in time to purchase the stock that got away that would've made you millions. But you can take steps in the present to help reach your long-term goals.Invest in a way that makes sense for you and your goals and avoid FOMO.

“The Stock Market is designed to transfer money from the Active to the Patient.”

-Warren Buffett