The purpose of the Balance sheet is to show the condition of its financial health of a business.

When flipping around on a company's annual report, normally I found myself blankly staring at dozens, or even hundreds, of pages of numbers and tables.

I am engineering trained and not used to look at huge numbers and these financial term.

What Is a Balance Sheet?

A balance sheet provides a picture of a company's assets and liabilities, as well as the amount owned by shareholders. These three components have to balanced out and are important information for the investors to understand the business strength.

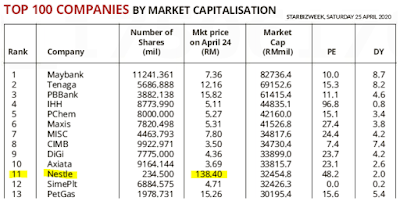

Let's start to analyze a real business balance sheet again by using yahoo finance. For this case study, will used back the same company during our study on the Income Statement.

Once you have search Nestle within the yahoo finance, click on the Balance Sheet and Annual balance sheet, you will have a sample table like below.

So the first part of the Balance Sheet is the break down of the company Assets. Assets consist of cash, investment, inventory and everything that business owned that can be liquidated into cash when needed. Analogy for us as a personal individual, our asset could be House, car, fixed deposit, shares, unit trust, gold etc can be sell off and get back our cash if we need to do so.

The total current Asset dated 12/30/2019, Nestle asset stand at 1.073 Billion. From google search, the meaning of current assets is simply cash and other assets that are expected to be converted to cash within a year.

As for the Non-current assets means the asset not able to convert into cash within the next 12 months. Warren Buffet called the Goodwill and Intangible as soft asset, because there are not a real asset.

From Investopedia, Goodwill is describe as an intangible asset that is associated with the purchase of one company by another. Specifically, goodwill is the portion of the purchase price that is higher than the sum of the net fair value of all of the assets purchased in the acquisition and the liabilities assumed in the process. The value of a company’s brand name, solid customer base, good customer relations, good employee relations, and proprietary technology represent some examples of goodwill.

Thus, Total non-current assets for Nestle is at 1.653 Billion. Then we sum up the Total Asset and Total non-current assets for Nestle is 2.726 Billion. After looking at the first component of the balance sheet on Asset, now we will move on to the next component which is Liabilities.

In layman term, it just like use we have housing loan, car loan, credit card outstanding etc are called liabilities that we owed to the bank. These are the money we need to pay in the near future. Expectation is all these liabilities to be payoff within next 12 months.

For Nestle, they have Current debt of 0.257 Billion and account payable of 1.133 Billion. Sum up will be 1.654 Billion. Nestle do not have any long term Debt but with Deferred Taxes liabilities under the Non-current Liabilities column.

Add up all the Total Current Liabilities and Non-current Liabilities will be 2.061 Billion

Let's move down to the bottom and will show the Total equities.

Total stockholders' equity of 0.664 Billion comprises of Common stock and Retained earnings (unrealised gain for business). The important number end up will be the Total stockholders' equity.

Total stockholders' equity = Total Asset - Total Liabilities

= 2,726,538 - 2,061,614

= 664,924

So the last row is Total liabilities and stockholders = Total Liabilities + Total stockholders' equity

= 2,061,614 + 664,924

= 2,726,538

After going through the three components in the Balance sheet, how do we know if this is financially stable or good? one way to find out is to find out the ratio of the Total Current Asset over Total current Liabilities.

Total Current Asset / Total current Liabilities = 1,073,013 / 1,654,750

= 0.648 (preferably to be above 1)

It just simply say that, if all the asset requires to dispose off, it will not able to payoff all the debts incurred. Thus, this will put the business in risk.

Second important to take note is the Total Cash and Total Current Asset if they are growing year after year. For instances, Nestle Total Cash is down from 23.996 Billion in 2016 down to just 10.399 Billion in 20192. As for Total Current Assets, it maintain flat 1.030 Billion in 2016 versus 1.073 Billion in 2019

Do the same undertanding and analysis for the Total current liabilities and Total Liabilities.

Form the Balance sheet we can observed that Nestle Total Current Liabilities is increasing over years. But the Current Asset did not increase. If compare the Total Asset Versus Total Liabilities, both are moving in the same direction with similar rate. For my opinion, it is still healthy.

As for the Total stockholders' equity, it looks like it is about flat and not growing much for shareholders.

All above sharing is just purely for educational purposes. Not a recommendation for buy or sell.Do your own due diligent.