What Is the Purpose of an Income Statement?

The purpose of the income statement is to show you if the company is making profit or loss during a period of time that the business is generating. Income statement also able to show the growth and operating margin of the business. We heard a lot of the top and bottom line in the business world, do you? You are able to find these two number in the income statement.

Some people called the income statement as a profit-and-loss statement, shows total revenues and total expenses over a specific time period.

In fact, you may prepare a simple and basic income statement for yourself. Let me show you in below example:

Here is an example of a basic income statement, covering the period of one month:

Your monthly income either from Sales or Salary (or Gross Income): $3,000

Additional Online sales income : $ 200

Total Income : $3,200

(-minus) Expenses:

House rent :$ 400

Dining out :$ 600

Petrol :$ 200

Phone Bill :$ 160

Total Expenses : $1,360

Net Income: $ 1,840

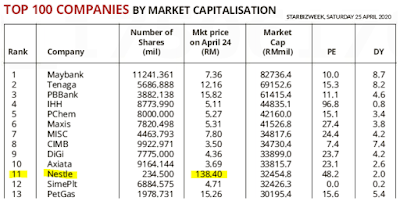

If you are able to understand above simple illustration on how will be the income statement like, you will be able to understand the company income statement in the next. Let's pick Nestle as an example to analyze it.

Normally I will be using yahoo finance to search for the company financials. Once you are in the yahoo finance and search for NESTLE, on the tab, click on the Financial and will bring you below statement.

Second column on the income statemen show that TTM. TTM stand for Trailing twelve month. On the 12/30/2019 Nestle is generating 5.518 billion Revenue. TTM showing the same as the last quarter report is not out yet. Once the Q1'2020 report is out the TTM number will be different from the 12/30/2019.

So the total revenue generated by Nestle shown here is the Top Line. This is the revenue generated before paying any expenses. The next line is the Cost of Revenue which is the total Manufacturing cost, advertising cost and delivering cost to the customers. After deducting from the Total Revenue, what left is the Gross Profit.

Gross profit = Total Revenue - Cost of Revenue

Gross profit will be used to calculate the Gross Margin.

Gross Margin = Gross profit / Total Revenue x 100%

= 2,073,515 / 5,518,076 x 100%

= 37.57 %

A such, the Nestle gross margin is 37.57%. Let's move on to check their expenses. Under expenses, there are Selling General and Administrative (SG&A) & Total Operating Expenses. For Nestle, Total Operating Expenses is 1.161 billion, 1.169 billion for SG&A.

Operating Income = Gross Profit - Total Operating Expenses

= 2,073,515 - 911,993

=1,161,522

The different of 1.169-1.161 = 0.008 Billion did not report in the yahoo finance. Thus, requires to look into the annual report posted by Nestle in order to find out the details.

Next line is the Operating Income or Loss for the Nestle is 0.911 B. If this line number show negative, then it signified that it was operating at loss.

Once we know the Operating income, we can find out the Operating Margin.

Operating Margin = Operating Income / Total Revenue x 100%

= 1,161,522 / 5,518,076 x 100%

= 21 %

Good operating margin should be above 15%. The higher the operating margin, the better it is. For this example, Nestle operating expenses is less than the Gross Profit. Otherwise, it will be at loss.

Now, let's move down next line, it show that Nestle has to pay Interest of 40.663 Million in last 12 months.

Income Before Tax = Operating Income or Loss - Interest Expense

= 911,993 - 40,663

= 875,725

After paying Income Tax of 202,812, the Net Income will be 672.913 Billion

This number is the bottom line which is widely used.

After going through the whole income statement here, hope you are able to understand the number well in your study of other company.

Some of the point to take note from the income statement

a) Operating Income or Loss: Must be positive

b) Net income number: Must be positive

Take a look on the history at least 5 to 10 years that enable you able to see the trend. Do not just look at 1 year data to gauge the company performance.

No comments:

Post a Comment